|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Refinance Rates Florida: A Comprehensive Overview for HomeownersRefinancing your home mortgage in Florida can be a strategic financial decision. Understanding the available options and current trends is crucial to maximizing your benefits. This guide will explore key aspects of refinance rates in Florida, providing insights and resources to help you make informed choices. Understanding Refinance RatesRefinance rates in Florida can vary based on several factors, including the overall economic climate, your credit score, and the type of loan you choose. It's important to compare rates from different lenders to find the most favorable terms. Factors Influencing Refinance Rates

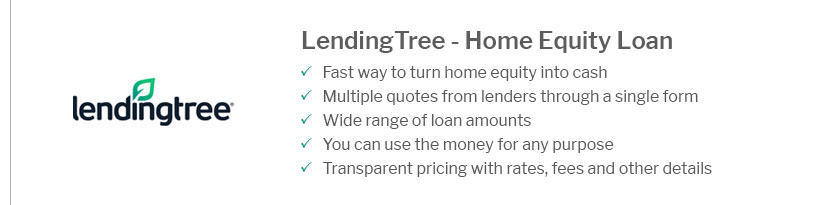

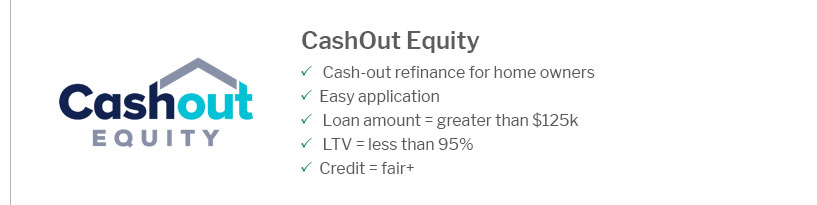

For example, checking the current 30 year jumbo rates could provide insights for those considering large loan amounts. Popular Refinance Options in FloridaHomeowners in Florida can choose from several refinancing options. Each has distinct advantages, making it important to align your choice with your financial goals. Rate-and-Term RefinanceThis is the most common option, allowing you to adjust the interest rate and term of your mortgage. It can help reduce monthly payments or shorten the loan term. Cash-Out RefinanceA cash-out refinance lets you borrow against your home's equity. This can be a strategic way to fund major expenses or consolidate debt. However, it's crucial to consider the implications of increasing your loan balance. Understanding what does harp loan mean can also offer insights into government-backed refinancing options that might suit specific circumstances. Steps to Refinancing Your Home

Frequently Asked Questions

https://www.alpinebanker.com/mortgage-rates-fl

The rates below are today's mortgage and refinance rates on our conventional, FHA and VA loan programs specifically tailored for Florida properties. https://smartasset.com/mortgage/florida-mortgage-rates

Use SmartAsset's mortgage rate comparison tool to compare mortgage rates from the top lenders and find the one that best suits your needs. https://www.seacoastbank.com/personal/lending/mortgages/mortgage-rates

Seacoast offers a variety of mortgage loans with competitive mortgage rates backed by our team of experienced mortgage lenders.

|

|---|